ETH: Decoding the Chart Dynamics

Dive into a comprehensive analysis of Ethereum as 2023 concludes, exploring the impact of Metamask's acquisition, SEC scrutiny, and the Ethereum 2.0 update. Understand the current technical indicators and market sentiment to gauge Ethereum's potential future movements.

10/20/20232 min read

Ethereum, has seen a turbulent year with multiple highs and lows. As we approach the end of 2023, it’s essential to analyze the data to determine potential price movements. This report delves into the various technical indicators, price levels, and recent news impacting Ethereum for a clearer picture of its future trajectory.

Recent News Impacting Ethereum:

Metamask Acquisition: Metamask, a popular Ethereum wallet and browser extension, was recently acquired for $5.7 billion. This acquisition indicates significant interest and investment in Ethereum-based products, which could potentially boost Ethereum’s usage and adoption.

SEC Scrutiny: Ethereum is under the SEC’s scrutiny concerning its initial coin offering (ICO). This has led to increased volatility in Ethereum’s price, with potential regulatory action being a significant factor to consider.

Ethereum 2.0 Update: The Ethereum 2.0 update, a major milestone for Ethereum’s transition to a proof-of-stake consensus mechanism, has been successfully implemented. This has been positively received by the community and can lead to increased scalability and reduced energy consumption for the Ethereum network.

Technical Indicators:

Stochastic (14, 1, 3): Currently at 69.48%K and 43.97%D, indicating a bullish momentum but nearing the overbought territory.

RSI (14): At 51.90, the RSI is in the neutral territory, showing no clear sign of overbought or oversold conditions.

OnBalanceVolume (OBV): Stands at 37.504M, reflecting decent buying pressure.

MACD: The MACD line is at -15.60, while the signal line is at -17.23. The histogram value of 1.63 suggests bullish momentum, with the MACD potentially gearing for a bullish crossover.

CMF (20): A value of -0.04 indicates neutral market sentiment with almost equal buying and selling pressure.

ATR (14): The ATR value of 44.73 indicates a decent volatility level.

ADX (14): At 19.58, the ADX suggests that the market trend isn’t strong.

Chart Analysis:

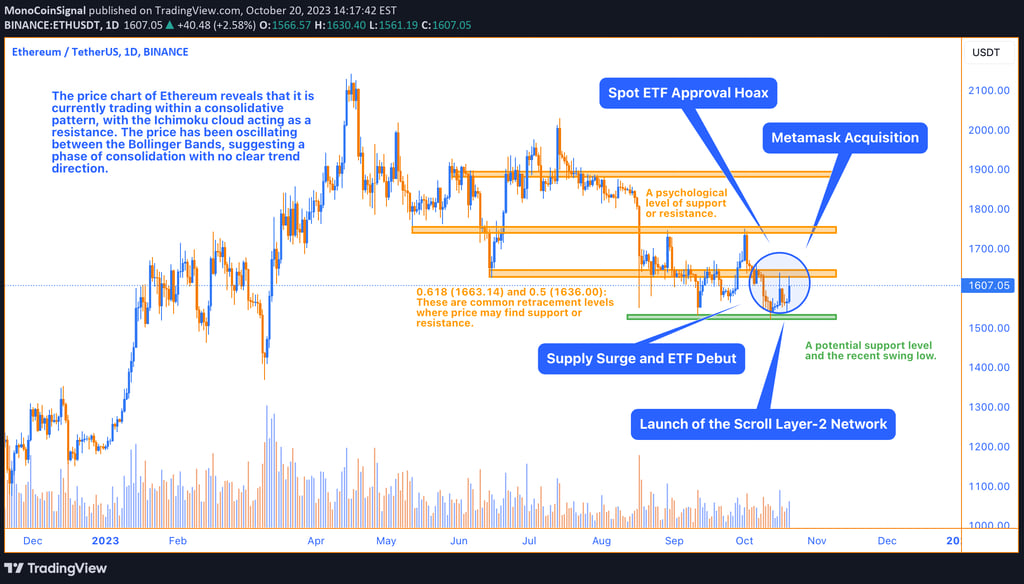

The price chart of Ethereum reveals that it is currently trading within a consolidative pattern, with the Ichimoku cloud acting as a resistance. The price has been oscillating between the Bollinger Bands, suggesting a phase of consolidation with no clear trend direction.

The Parabolic SAR is below the price, indicating a bullish sentiment. Additionally, the Simple Moving Average (SMA) stands at 1567.55, and the price is currently hovering around this level.

Conclusion:

Ethereum’s technical analysis, combined with recent developments, paints a multifaceted picture. While the technical indicators display a consolidative pattern with mixed momentum signals, the news suggests varying impacts on Ethereum’s future. The Metamask acquisition and Ethereum 2.0 updates present bullish sentiments, but the SEC’s scrutiny poses potential headwinds.

Given the proximity to crucial Fibonacci levels and the SMA, traders should remain cautious and monitor these zones for potential price movements. It’s imperative to set stop losses and stay updated with both technical and fundamental developments, ensuring informed trading decisions.

Note: This analysis is for informational purposes only and is not financial advice. Always conduct your research before making any investment decisions.