Bitcoin's Pivotal Moment: Bullish Surge or Bearish Retreat?

Delve into an in-depth analysis of Bitcoin's current market trajectory. From regulatory challenges and retail adoption to the technical indicators on the 4H chart, grasp the potential scenarios that could shape Bitcoin's future. Discover whether the sentiment leans bullish or bearish and how global events are influencing the digital currency's direction.

10/24/20232 min read

With the dance of regulatory decisions and surging retail enthusiasm, Bitcoin's course becomes both an enigma and an opportunity. As we stand at the crossroads of impactful global events and technical indicators, the journey ahead demands a closer look.

Part I: Market Landscape:

Regulatory Developments: Intensifying crypto scrutiny in the U.S., China, and EU regions brings with it potential turbulence. Short-term price fluctuations are anticipated, but clarity in regulations could usher in a phase of long-term market maturity.

Retail Acceptance: The burgeoning retail acceptance across Europe and Asia remains a beacon of optimism. This progression not only fuels Bitcoin's demand but carves out a broader role for it beyond mere speculative interest.

U.S. Banks & Crypto: The pivotal move by traditional U.S. banks to embrace crypto trading signifies institutional validation. The implications range from bolstered trading volumes to a heightened stature for Bitcoin in the financial echelon.

Environmental Concerns: As the environmental discourse around Bitcoin intensifies, public sentiment oscillates. The outcomes of this dialogue could shape retail investment inclinations.

Part II: Technical Landscape on the 4H Chart:

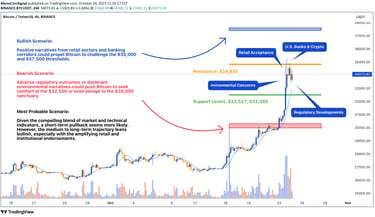

Current Price: Bitcoin's stance at $33,640 is pivotal for the days ahead.

Bollinger Bands: Approaching the upper band, a price pullback looms, signaling overbought dynamics.

RSI: A reading of 75.70 in the RSI concurs with the Bollinger Bands, hinting at overbought conditions.

Part III: Potential Scenarios, Key Price Points, & Probable Direction:

Bullish Scenario: Positive narratives from retail sectors and banking corridors could propel Bitcoin to challenge the $35,000 and $37,500 thresholds.

Bearish Scenario: Adverse regulatory outcomes or dominant environmental narratives could push Bitcoin to seek comfort at the $32,500 or even plunge to the $30,000 sanctuary.

Most Probable Scenario: Given the compelling blend of market and technical indicators, a short-term pullback seems more likely. However, the medium to long-term trajectory leans bullish, especially with the amplifying retail and institutional endorsements.

Part IV: Future Sentiment - Bullish or Bearish?

Balancing the scales of external market influences and technical readings, the future of Bitcoin seems cautiously optimistic. While immediate price actions might witness volatility, the underlying fundamentals, especially retail and banking adoption, could be the wind beneath Bitcoin's wings, fostering a bullish sentiment in the longer run.

Conclusion:

Bitcoin's narrative is intricate and multifaceted. With immediate technical indicators signaling caution, the overarching market developments could very well dictate its brighter future. Traders and investors are advised to tread with insight, keeping both the micro and macro perspectives in play.