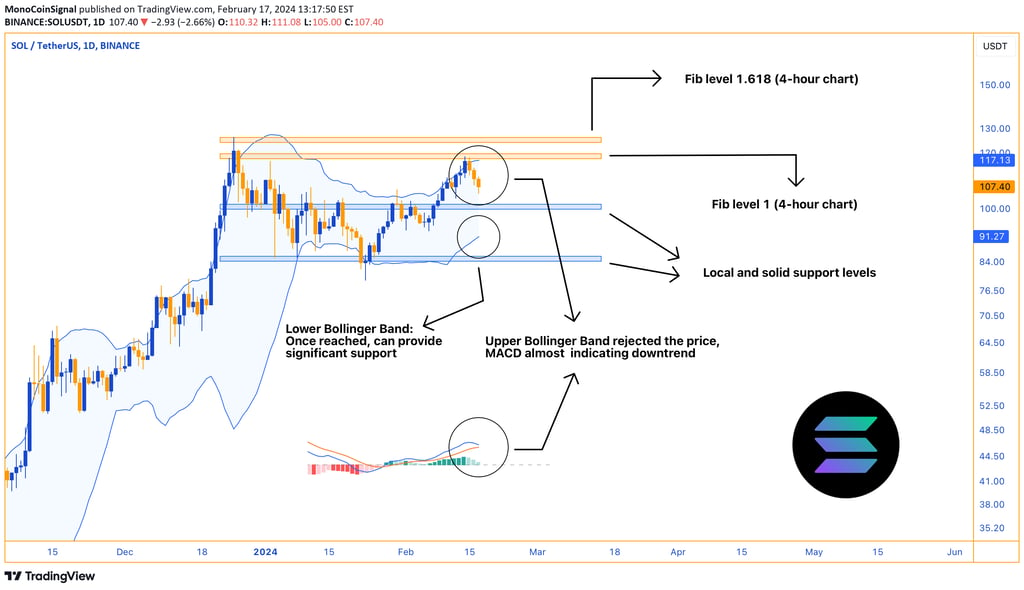

A Technical Look at SOL's Next Moves

Solana's recent price movements encounter resistance at the 4-hour chart's 0 Fibonacci level, with the current price at $107 just below this crucial point. A rejection at the upper Bollinger Band signals a potential short-term ceiling for the price, and the widened Bollinger Bands suggest increased market volatility. While the MACD remains in bullish territory, the close-to-baseline histogram hints at a possible slowdown in momentum or a forthcoming bearish crossover. RSI at 55.38 indicates neutral conditions, but the RSI-based MA suggests recent bullish momentum. Trading volume at 2.462M supports the significance of recent price action. Traders should consider the lower Bollinger Band around $91.27 as a key support area, and a break below could lead to a deeper retracement. Monitoring for consolidation above the Fib level or a break below is crucial for trend analysis.

2/17/20241 min read

Solana's price movements have recently led it to confront the 4-hour chart's 0 Fibonacci level, acting as a crucial resistance point. The current price of $107 sits just below this level, after a rejection at the upper Bollinger Band, indicating a potential short-term ceiling for the price. The Bollinger Bands have widened, suggesting increased market volatility and a possible expansion phase in price action.

The MACD presents a nuanced picture; while it remains in bullish territory with the MACD line (4.42) above the signal line (3.87), the histogram is very close to the baseline, hinting at a possible slowdown in momentum or an impending bearish crossover. This warrants attention as it could precede a change in the trend direction.

Furthermore, the RSI at 55.38 is in the mid-range, not indicating overbought or oversold conditions, but the RSI-based MA is slightly higher at 60.13, which might suggest that the average momentum has been more bullish recently. Trading volume stands at 2.462M, which provides enough market participation to consider the recent price action as significant.

Traders might look to the lower Bollinger Band around $91.27 as a key support area, as historically, prices touching this band have often found substantial buying interest. If the price were to break below, the next regions of interest would be the local and solid support levels that have been established previously.

Given the recent price rejection and the MACD's hint at a potential downturn, traders should monitor for either a consolidation above the current Fib level to support a continued uptrend or a break below, which could indicate a deeper retracement is due.